Tiimely Household get earnings from Tiimely Own finance and you can, where customers sign up for a loan to the help of a good Tiimely House agent, of fund settled with committee lenders. Considerably more details about the credit features provided with Tiimely House is obtainable in the fresh Tiimely House Borrowing Publication (PDF) and you can Tiimely Household Broker Borrowing from the bank Book (PDF). You’ll get a professional assessment once you begin a credit card applicatoin, and you may enter the details of the house or property, your loan type, personal statistics plus financials.

Just how do expenses apply to my borrowing from the bank energy?

The greater your home loan borrowing from the bank strength, more alternatives you will get.

Plus the great news are, there are plenty of a way to aid in increasing the borrowing from the bank capacity In case your borrowing from the bank skill is lower than you’d such. After you’re filling out your application, make sure to wear’t forget about your entire earnings source. They are dividends, leasing earnings for those who currently own a financial investment property, side hustles, bodies payments and you may son support.

- All Software is actually at the mercy of credit score assessment, eligibility conditions and credit constraints.

- You could essentially increase your credit energy by the because of the points one to determine it and working throughout these myself.

- To own mortgage brokers, the base requirements is an excellent $five-hundred,100000 amount borrowed more three decades.

- Stephen guides all of us out of Lenders, and you will recommendations and you will contributes to Examine the market’s banking-relevant articles to ensure it’s while the helpful and you can strengthening to in regards to our clients.

- Expertise their credit strength can help you build told behavior about how much you can afford so you can use to have intentions such to purchase a good house, spending, and other economic demands.

Save your time that have a quick respond to

For many who’re contemplating to shop for property later, take effect on your borrowing as quickly as possible. While the balance of one’s financing comes down, thus really does the eye charged each time. Because your mortgage repayments is left a comparable every month (offered the interest rate hasn’t changed), the main your’lso are paying back slowly grows when. Nonetheless they mean your home mortgage equilibrium drops slower at first, following slowly shrinks smaller. As you achieve the prevent of your loan’s identity (say twenty five years) your debts decreases most easily, because you’lso are using way less focus. But not, the new percentage size of the put doesn’t determine just how much you can acquire inside the dollars words.

We could let very first time customers, remortgages, buy-to-lets, household moving companies and much more. A HELOC are a powerful unit, however it is imperative to see the threats in it, away from changeable prices to foreclosure. If you stimulate your own Lime Casual debit card ranging from 21 July 2025 and you may 30 February 2026, there may be a delayed in automatic enrolment for the ING Wallet Rewards. It will be possible to manually enroll the new cards your self by signing to your mobile banking and navigating to the credit, next trying to find “ING Pouch Advantages”. Once you accomplish that, their card might possibly be enrolled which have immediate feeling. They doesn’t matter if you’ve never ever purchased assets in the market ahead of, it’s everything about staying with an agenda and being prepared.

The speed shown ‘s the Ease And Mortgage directory quicker the newest appropriate unique offer write off. Eligibility requirements apply at unique provide discounts, along with $50,one hundred thousand or more inside the the newest otherwise a lot more ANZ credit. Borrowing power form how much money a lender you are going to provide you based on how far you have made, what you spend, as well as how much loans you currently have. I view things like your own salary, debts, credit cards, fund, as well as how a lot of people confidence you.

He previously struggled to obtain Bankrate, where the guy safeguarded the newest property increase and you will breasts. Holden is past chairman of one’s National Relationship away from A property Publishers and you will acquired numerous composing honours. Speak to your lender, debt mentor, and/otherwise a houses counselor to own guidance or guidance related to their specific problem. Financial hand calculators give you a precise address based on the guidance your get into and the assumptions the fresh calculator can make.

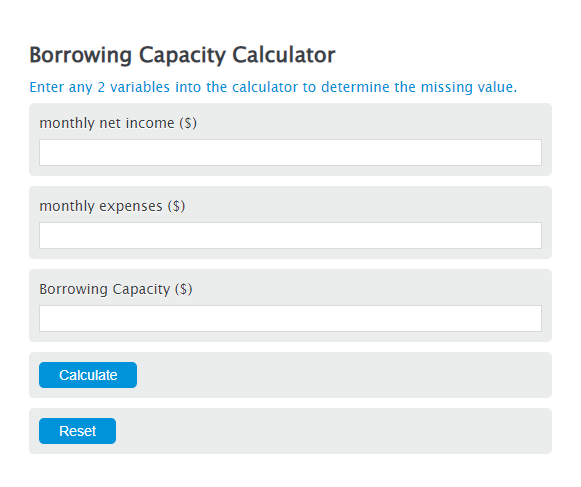

Whenever we’re also assisting you to sign up for a home loan, we could model your circumstances centered on a reduced or no borrowing limit, that may improve your possible borrowing energy. All of our borrowing power calculator provides you with a fast imagine considering your earnings, expenses and financial predicament. It’s a good 1st step to learn your residence mortgage possibilities and you will bundle confidently.

Understand that our very own borrowing from the bank electricity calculator will bring simply a keen estimate and does not make sure you will be approved regarding number. Per lender has other financing criteria, making all condition book. The newest guess is dependant on the precision of the guidance offered. Prices is any unique give disregard on eligible finance (discounts and you can qualification standards at the mercy of change). Qualifications conditions apply to unique make discounts available to possess ANZ Simplicity And mortgage brokers, in addition to $50,100 or more in the the new or extra financing. The newest imagine might possibly be additional when the percentage kind of is actually focus just or if perhaps another rate of interest discount is applicable.

Having fun with our credit calculator offers an idea of just what your borrowing power.Find out more about what gets into calculating the borrowing energy. Lenders’ Mortgage Insurance is always necessary once you use more than 80% of one’s worth of your property. It’s applied for to guard the lending company, maybe not the customer, protecting the financial institution if you’lso are struggling to pay the loan later. It’s a non-refundable, non-transferable one-from payment one to’s charged to the debtor whenever a mortgage try pulled away.

These types of on the internet systems wanted very first property suggestions and gives a quotation of one’s stamp obligations you will have to spend. For exact advice, it is required to see benefits including the educated mortgage brokers at the Ello Financing. Call us now to possess individualized help with your property financing demands. Most other information+Tiimely Home is known for the quick approvals to have Tiimely Very own products and responsive services, powered by our technology and supported by all of us out of professionals.

Our very own borrowing from the bank matter calculator is an instant-quotation style tool designed to leave you a keen an indication quantity of how much you might use. Our very own affordability calculator requires more in depth questions to offer a better image of your general cost. Take note that is only a quote and certainly will will vary centered to your bank plus individual issues. The borrowing from the bank calculator was created to help you work out how far you could potentially acquire, and this gets you a stride closer to possessing your property. However, your own limit price can get improve if you have a top deposit.

The usage of such words in order to a particular product is subject to change without warning if the merchant change the costs. House expense measurement (HEM) are a standard you to definitely lenders use to guess a debtor’s bills inside research of home loan programs. It gives a basic measure of regular household paying considering points such as earnings and you will family proportions.

For example one current finance or expenses that you have, such home financing, auto loan or credit card debt. It’s vital that you be honest regarding the debts because this usually help lenders to decide the credit ability.Total, it’s vital that you be truthful and you may realistic whenever evaluating your borrowing from the bank energy. Do your research and make certain that you understand all issues that may feeling your own borrowing from the bank skill. This can help you generate informed choices in terms of trying to get that loan. The new Lending Skill Formula is one of the most extremely important products used by lenders whenever examining a good borrower’s credit strength. This is done because of the deducting the fresh borrower’s current debts off their total money, and subtracting the monthly expenditures using this contour.